Reducing fuel, emissions, maintenance and insurance costs and increasing employee retention

The urgency to reduce aviation's environmental impact is undeniable. With one-fifth of the world's largest companies setting net-zero targets, responsible emissions management goes beyond just CO2.

Aviation faces a complex challenge. While promising new technologies are on the horizon, their widespread adoption remains years away. Global jet fuel consumption continues to climb, and achieving net-zero in aviation will require a multi-pronged approach.

FuelVision is a critical piece of the puzzle. We offer immediate solutions to bridge the gap, helping airlines reduce not just CO2 emissions, but also non-CO2 pollutants. Our tools empower pilots and airlines to optimise flights, fostering a culture of continuous improvement and environmental awareness. FuelVision's solutions are designed to work alongside and complement future advancements, optimising our resources and production emissions.

Here's how FuelVision can help airlines achieve immediate and long-term environmental benefits.

Built by pilots for pilots

Founded on flight deck experience we evolve with your pilots' feedback.

Enabling daily training

Encouraging a growth mindset by providing personalised training after every flight.

Cultural change

Fostering a culture of safety & efficiency through positive reinforcement.

Flight Efficiency - FuelVision App

Built by pilots for pilots

- Enabling data driven decisions before flight

- Historical data based on route selection

- Building a more informed and responsible operation

- Promoting best practices

Making every flight rewarding

- Instant insights after flight

- Personalised & confidential feedback

- Focused on progress & motivation

- Direct data transfer from the aircraft, no user input needed

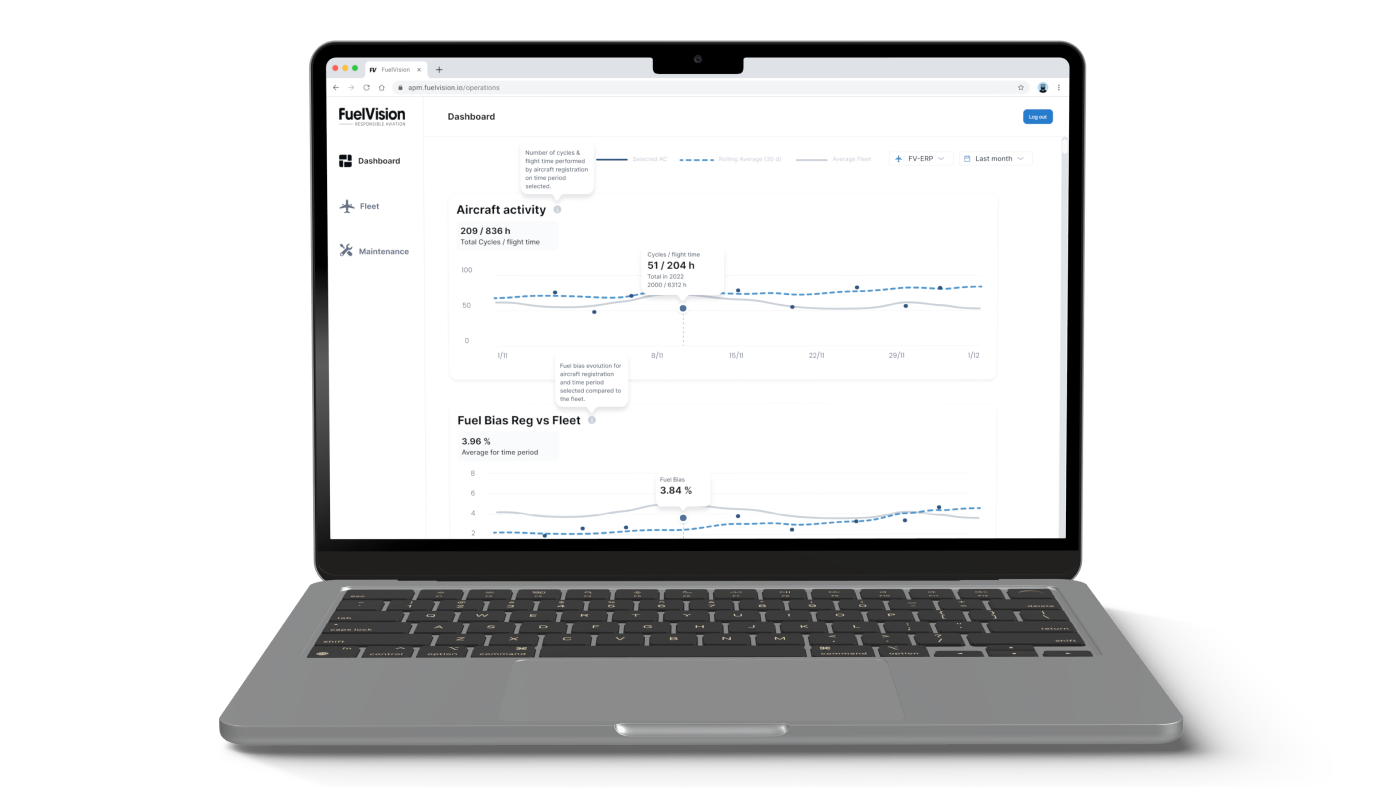

Fleet Efficiency - Aircraft Performance Monitoring

Markets

From financial planning to operational reality

That's responsible financial risk control!

Hedging guideline

- How derivatives work

- Why hedging strategies should be grounded in corporate and financial goals as well as fleet types, size and competition

- Development of consistent strategies where both oil price risk and financial instrument risk are handled and monitored

- Connection between oil price development and financial instruments as well as connection to jet fuel

Use cases

FuelVision provides a holistic solution using the same flight data, connecting your business and building a more responsible operation.

Check the value you get based on your role within the company.

CEO & CFO

We bridge the gap between your finance department and your operational reality.

Our Markets offer uses the same flight data for:

- Accurate exposure estimates.

- Better handling of Carbon emission allowances & reporting.

- Building a 365º financial risk management.

- Monthly relevant markets updates.

Chief Pilot & DFO

Working closely to set targets for emission savings, wear and tear and any necessary workshop for a smooth implementation of our Flight Efficiency program.

Monthly collective reports per base and goals.

Pilots

Driving positive impact from the flight deck, because you are the professionals and should have the best tool to work with.

- Making more informed decisions.

- Tracking your progression & impact, private access.

- Monthly collective impact, uniting pilots for the same goal.

Customer testimonials

“FuelVision assisted on our Fly Great initiative and showed how large a savings potential there is from flying a little differently. Further, they assisted us in creating clear financial risk strategies increasing the understanding between financial and operational departments”

Thomas Hugo, CEO of GDA

User testimonials

"FuelVision has enabled me to have eyes on my flying, evaluate and fine tune my skills to get a better performance and also see the impact of my changes. An easy access to a tool were we all can improve our professionalism bit by bit. Small changes in flying will in second hand impact the climate footprint something we all owe the coming generation."

Peter Persson, First Officer B737